Next week on Wednesday, the annual closed-door central economic work conference will begin, during which China’s top officials will discuss economic goals and stimulus initiatives for 2025. According to Bloomberg sources, the two-day summit will be attended by prominent Chinese officials. Investors will be watching to see how the leaders of the world's second-largest economy want to manage fiscal, monetary, and industrial policy. Last year's summit took place on the same dates and was attended by senior financial regulators and members of the nation's top leadership, including President Xi Jinping. The leaders of the ruling communist party probably won't say anything about the start time of the meeting. The public will only find out that it has happened when the minutes are released. The exact figures won't be disclosed until March's annual parliament session. However, investors will scan the statement for indications of the lawmakers' decisions. The return of Donald Trump to the white house brings a tariff war that may demolish bilateral commerce. Still, senior leaders are expected to debate keeping next year's growth rate in line with the 2024 target of about 5 per cent. Economists from the UBS group and Barclays predict that policymakers will aim for a larger-than-usual deficit, between 3.5 and 4 per cent of GDP. If that were to happen, the government might borrow additional money to support the struggling economy. Rate cuts and a 1.4 trillion-dollar initiative to rescue distressed local governments are among the several stimulus measures unveiled by authorities since late September. China is now on course to meet its growth target for this year. However, authorities will likely want to leave some wiggle room in policy in preparation for the incoming US President. Trump has threatened China with two new tariffs in the last week. The People's Bank of China (PBOC) has pledged plans for a supportive monetary policy to encourage growth next year. This comes ahead of the impending trade war with the US. PBOC governor Pan Gongsheng at a financial forum in Beijing, said, the central bank will “adhere to an accommodative monetary policy stance and orientation” in 2025. Next year, China’s economy will need monetary policy assistance more than ever before, especially because the US president-elect has promised to put high tariffs on Chinese imports. Since the pandemic, exports have been a major engine of China's economic development, but that forecast is now in jeopardy. (With inputs from Bloomberg) A journalist, writing for the WION Business desk. Bringing you insightful business news with a touch of creativity and simplicity. Find me on Instagram as Zihvee, tr None

Popular Tags:

Share This Post:

Money-Wise: Planning to become a SIP expert? Here are some golden rules to reap profits

December 20, 2024

US economy expanded faster in third quarter than originally estimated: Data

December 19, 2024What’s New

Fed's rate cut sparks inflation concerns, market selloff

- By Sarkai Info

- December 19, 2024

Spotlight

China's regulators vow to stabilise property, stock markets

- by Sarkai Info

- December 16, 2024

Ghana's president-elect says IMF deal to cap radical reforms

- by Sarkai Info

- December 16, 2024

Today’s Hot

-

- December 15, 2024

-

- December 15, 2024

-

- December 15, 2024

Fed to cut rates once more before slowing the pace in 2025

- By Sarkai Info

- December 14, 2024

Broadcom sees massive opportunity over the next three years

- By Sarkai Info

- December 14, 2024

China struggles with deflation and looming trade battle

- By Sarkai Info

- December 14, 2024

Featured News

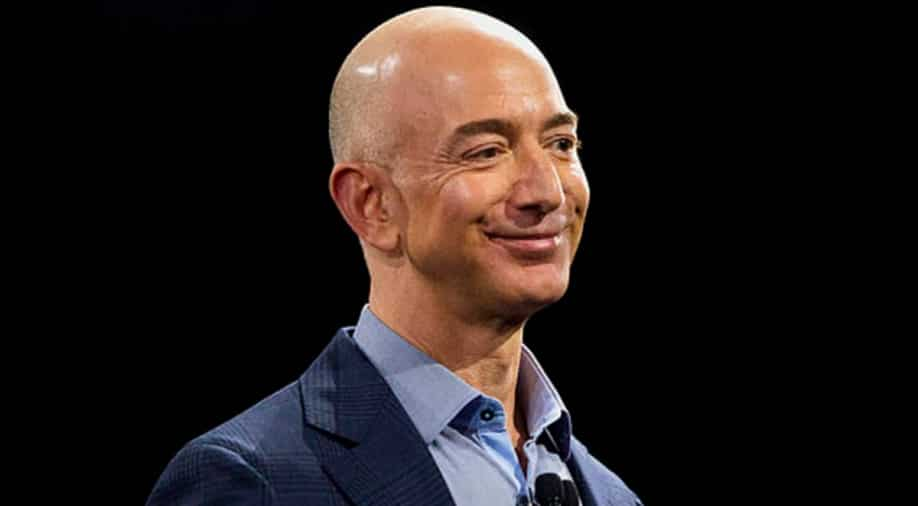

Bezos prepares for new administration amid Kuiper delays

- By Sarkai Info

- December 14, 2024

Latest From This Week

Russia faces delays in trade settlements caused by US pressure

BUSINESS-ECONOMY

- by Sarkai Info

- December 13, 2024

China steps up stimulus to recharge growth ahead of US tariffs

BUSINESS-ECONOMY

- by Sarkai Info

- December 13, 2024

From TikTok to Nvidia, The US-China tech war is getting uglier

BUSINESS-ECONOMY

- by Sarkai Info

- December 13, 2024

Subscribe To Our Newsletter

No spam, notifications only about new products, updates.

Popular News

Top Picks

US weighing new, harsher sanctions on Russia's lucrative oil trade

- December 12, 2024

China gets a head start on a looming trade war with the US

- December 12, 2024

World Bank predicts Myanmar's economy to contract this year

- December 12, 2024