The predicted increase in demand for Broadcom's artificial intelligence processors led to a first-ever leap to a one trillion-dollar market capitalisation for the tech firm. Broadcom is the semiconductor supplier to Apple and other major tech companies. The company predicts sales of AI devices will increase by 65 per cent, which is significantly higher than the 10 per cent growth in overall semiconductor sales. Additionally, by fiscal 2027, the chipmaker anticipated that the addressable market for data centre operators' AI components it produces might reach 90 billion dollars. The semiconductor company is aiming to cash on the AI investment frenzy, much like Nvidia. Chief executive officer Hock Tan announced his business has secured clients from the largest data centre operators, known as hyperscalers. On Friday, the stock price increased by as much as 21 per cent, marking its largest share-price surge since March 2020. The hope for AI has attracted investors, who have flocked to Broadcom's shares this year. Demand for processors and networking components drove AI sales growth of 220 per cent over the year, according to Tan. Consistent with projections, total sales for the period ending in January will come at 14.6 billion dollars. (With inputs from the agencies) A journalist, writing for the WION Business desk. Bringing you insightful business news with a touch of creativity and simplicity. Find me on Instagram as Zihvee, tr None

Popular Tags:

Share This Post:

Money-Wise: Planning to become a SIP expert? Here are some golden rules to reap profits

December 20, 2024

US economy expanded faster in third quarter than originally estimated: Data

December 19, 2024What’s New

Fed's rate cut sparks inflation concerns, market selloff

- By Sarkai Info

- December 19, 2024

Spotlight

China's regulators vow to stabilise property, stock markets

- by Sarkai Info

- December 16, 2024

Ghana's president-elect says IMF deal to cap radical reforms

- by Sarkai Info

- December 16, 2024

Today’s Hot

-

- December 15, 2024

-

- December 15, 2024

-

- December 15, 2024

Fed to cut rates once more before slowing the pace in 2025

- By Sarkai Info

- December 14, 2024

Broadcom sees massive opportunity over the next three years

- By Sarkai Info

- December 14, 2024

China struggles with deflation and looming trade battle

- By Sarkai Info

- December 14, 2024

Featured News

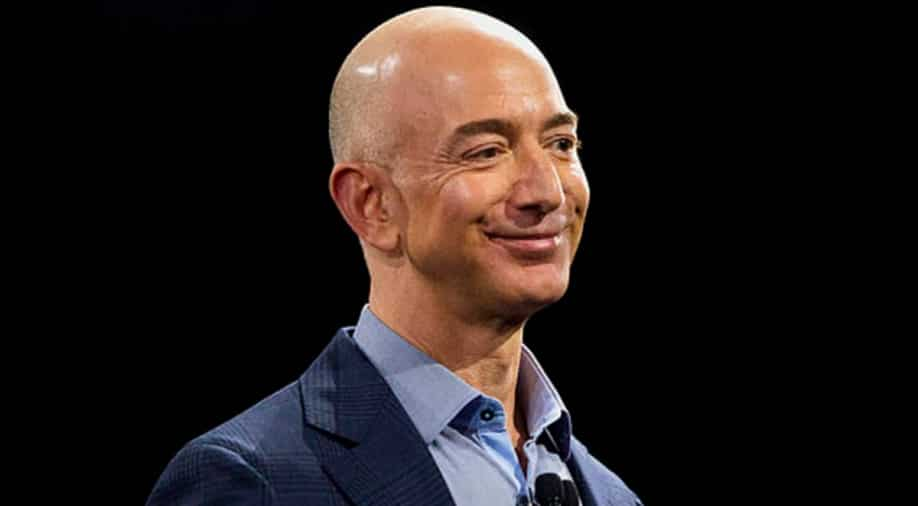

Bezos prepares for new administration amid Kuiper delays

- By Sarkai Info

- December 14, 2024

Latest From This Week

Russia faces delays in trade settlements caused by US pressure

BUSINESS-ECONOMY

- by Sarkai Info

- December 13, 2024

China steps up stimulus to recharge growth ahead of US tariffs

BUSINESS-ECONOMY

- by Sarkai Info

- December 13, 2024

From TikTok to Nvidia, The US-China tech war is getting uglier

BUSINESS-ECONOMY

- by Sarkai Info

- December 13, 2024

Subscribe To Our Newsletter

No spam, notifications only about new products, updates.

Popular News

Top Picks

US weighing new, harsher sanctions on Russia's lucrative oil trade

- December 12, 2024

China gets a head start on a looming trade war with the US

- December 12, 2024

World Bank predicts Myanmar's economy to contract this year

- December 12, 2024