A Systematic Investment Plan or SIP has become one of the key investments in people's planning for their financial future and is believed to speed up the journey towards financial goals. However, how simple an investment in SIP may sound, in reality, it involves some rules which can really up the game for the investors. In this week's Money-Wise, we try to understand the golden rules for investing in SIP for building long-term wealth. This triple 5 rule is best for planning retirement savings. The rule states that the investor should retire five years before stipulated retirement, increase SIP by 5 per cent every year, and aim to create a fund of Rs 52.8 million (approx. $620661) by the age of 55. As per this rule, the principal amount should be invested in SIP for 15 years, and it should be then extended for the next 5 years and again extended for 3 years to churn a good profit. This rule should be implemented when you are doing financial planning for your child. The rules say that the investment should be done before your child turns 18. The monthly SIP deduction ideally should be Rs 15,000 (approx. $176.32) and the investor should target a 12 per cent return. Also Read: Money-Wise | SIP or lumpsum: What is a better mutual fund investment? This rule advocates investing a monthly SIP of Rs 10,000 for 20 years and aiming for a 15 per cent return. As per this rule, investors should invest in SIPs across 15 years an amount of Rs 15,000 monthly and target an annualised return of 15 per cent. The 8-4-3 rule demonstrates how a SIP grows through the years because of the power of compounding. The rule says that the investments see steady growth in the first eight years and are likely to bring an average annual return of 12 per cent. From the ninth to the twelfth year, the investment doubles and sees the same growth which took place in the last eight years because of the power of compounding. Watch: Asian Stocks Edge Higher as Investors Focus on Fed's Next Move After the last three years, the SIP investment achieves exponential growth and once again doubles. This rule says that equity investments generally perform well in seven years, and their profit-churning capacity can be further enhanced by distributing funds in five categories, which also mitigates concentrated risks. Diversification of funds is important to bring stability to the investment and ensure growth in investment portfolios. The investor can diversify funds in these categories: High-Quality Stocks (Large Cap Stocks), Value Stocks, GARP Stocks (Growth at Reasonable Price), Midcap or Small Cap Stocks and Global Stocks. The number "3" stands for patience in dealing with low returns, minimum returns, and at times even negative returns when the market turns volatile. And "1" refers to increasing the SIP amount for fighting the increasing inflation. A small increase in monthly SIP deductions can bring a big difference in profits. Prisha is a digital journalist at WION. With almost 10 years of experience in international journalism, she majorly covers political and trending stories. She also f None

Popular Tags:

Share This Post:

Money-Wise: Planning to become a SIP expert? Here are some golden rules to reap profits

December 20, 2024

US economy expanded faster in third quarter than originally estimated: Data

December 19, 2024What’s New

Fed's rate cut sparks inflation concerns, market selloff

- By Sarkai Info

- December 19, 2024

Spotlight

China's regulators vow to stabilise property, stock markets

- by Sarkai Info

- December 16, 2024

Ghana's president-elect says IMF deal to cap radical reforms

- by Sarkai Info

- December 16, 2024

Today’s Hot

-

- December 15, 2024

-

- December 15, 2024

-

- December 15, 2024

Fed to cut rates once more before slowing the pace in 2025

- By Sarkai Info

- December 14, 2024

Broadcom sees massive opportunity over the next three years

- By Sarkai Info

- December 14, 2024

China struggles with deflation and looming trade battle

- By Sarkai Info

- December 14, 2024

Featured News

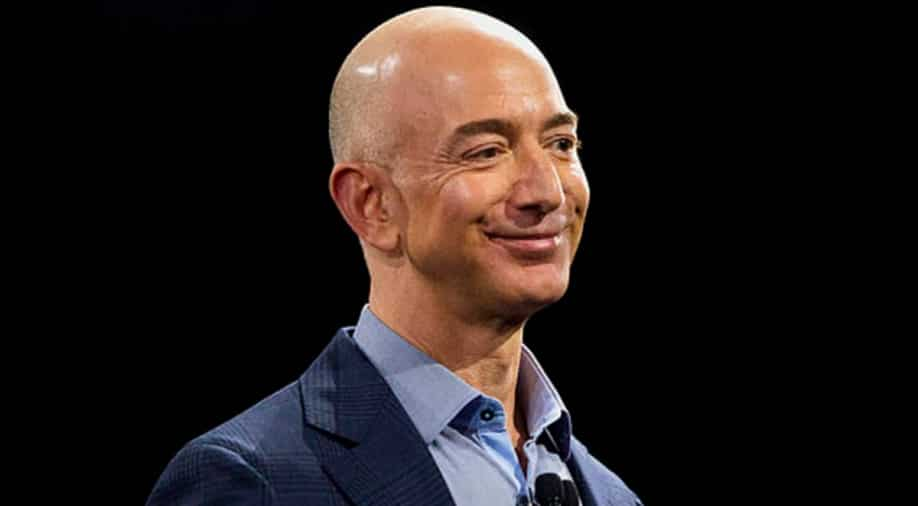

Bezos prepares for new administration amid Kuiper delays

- By Sarkai Info

- December 14, 2024

Latest From This Week

Russia faces delays in trade settlements caused by US pressure

BUSINESS-ECONOMY

- by Sarkai Info

- December 13, 2024

China steps up stimulus to recharge growth ahead of US tariffs

BUSINESS-ECONOMY

- by Sarkai Info

- December 13, 2024

From TikTok to Nvidia, The US-China tech war is getting uglier

BUSINESS-ECONOMY

- by Sarkai Info

- December 13, 2024

Subscribe To Our Newsletter

No spam, notifications only about new products, updates.

Popular News

Top Picks

US weighing new, harsher sanctions on Russia's lucrative oil trade

- December 12, 2024

China gets a head start on a looming trade war with the US

- December 12, 2024

World Bank predicts Myanmar's economy to contract this year

- December 12, 2024