JPMorgan's annual outlook warns that emerging markets face a turbulent 2025, with significant uncertainty stemming from policy shifts in the United States and ongoing challenges in China. The bank predicts that growth across emerging markets will slow to 3.4 per cent in 2025, down from 4.1 per cent this year. Excluding China, growth is expected to moderate further to 3.0 per cent, from 3.4 per cent in 2024. The outlook highlights how us policy changes could trigger a negative supply shock, creating ripple effects across emerging economies. With a stronger dollar and higher rates on the horizon, emerging-market bond funds are projected to face outflows between $5 billion and $15 billion in 2025. JPMorgan's report outlines a challenging year for emerging-market fixed income. The return of a Republican-led us government under Donald Trump is anticipated to bring tariff policies, geopolitical shifts, and domestic changes that could strengthen the dollar and elevate interest rates. These factors will weigh heavily on sentiment towards emerging markets, particularly their sovereign debt. Despite these risks, the bank forecasts a 4.3 per cent return for hard-currency sovereign debt by the end of 2025, a decline from the 6.9 per cent return expected for 2024. The bank's debt issuance forecast shows a slight decline in hard-currency sovereign gross issuance to just below the 2024 level. However, rising debt amortizations mean net financing will drop significantly. On the market-specific front, JPMorgan has removed its overweight recommendation on the Dominican Republic's sovereign debt, Although it expects the country to attain investment-grade status within four years. Additionally, the bank has turned underweight on Indonesia's local rates, signalling caution as emerging markets navigate a challenging year ahead. (With inputs from agencies) A journalist, writing for the WION Business desk. Bringing you insightful business news with a touch of creativity and simplicity. Find me on Instagram as Zihvee, tr None

Popular Tags:

Share This Post:

Money-Wise: Planning to become a SIP expert? Here are some golden rules to reap profits

December 20, 2024

US economy expanded faster in third quarter than originally estimated: Data

December 19, 2024What’s New

Fed's rate cut sparks inflation concerns, market selloff

- By Sarkai Info

- December 19, 2024

Spotlight

China's regulators vow to stabilise property, stock markets

- by Sarkai Info

- December 16, 2024

Ghana's president-elect says IMF deal to cap radical reforms

- by Sarkai Info

- December 16, 2024

Today’s Hot

-

- December 15, 2024

-

- December 15, 2024

-

- December 15, 2024

Fed to cut rates once more before slowing the pace in 2025

- By Sarkai Info

- December 14, 2024

Broadcom sees massive opportunity over the next three years

- By Sarkai Info

- December 14, 2024

China struggles with deflation and looming trade battle

- By Sarkai Info

- December 14, 2024

Featured News

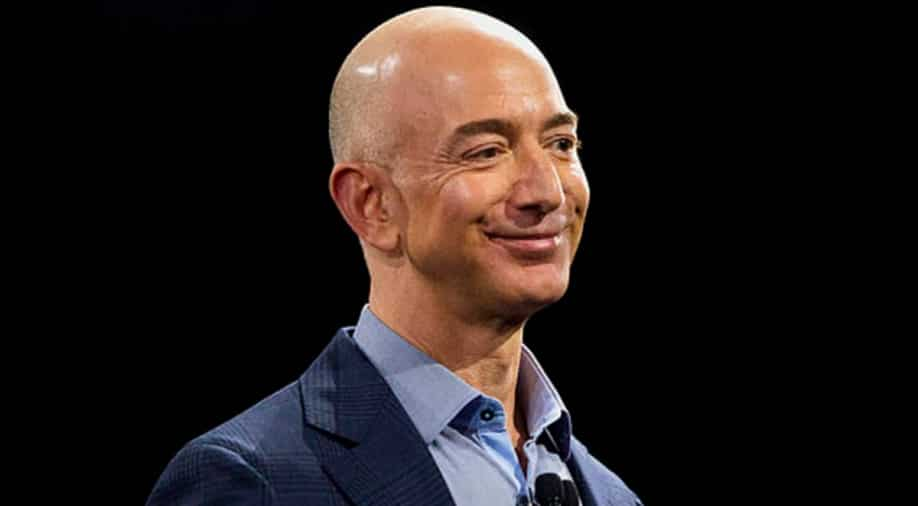

Bezos prepares for new administration amid Kuiper delays

- By Sarkai Info

- December 14, 2024

Latest From This Week

Russia faces delays in trade settlements caused by US pressure

BUSINESS-ECONOMY

- by Sarkai Info

- December 13, 2024

China steps up stimulus to recharge growth ahead of US tariffs

BUSINESS-ECONOMY

- by Sarkai Info

- December 13, 2024

From TikTok to Nvidia, The US-China tech war is getting uglier

BUSINESS-ECONOMY

- by Sarkai Info

- December 13, 2024

Subscribe To Our Newsletter

No spam, notifications only about new products, updates.

Popular News

Top Picks

US weighing new, harsher sanctions on Russia's lucrative oil trade

- December 12, 2024

China gets a head start on a looming trade war with the US

- December 12, 2024

World Bank predicts Myanmar's economy to contract this year

- December 12, 2024