After months of underperformance for French equities, last week saw a little relief surge. However, given that France's political instability is expected to persist and the country's overstretched public finances are discouraging long-term investment, this might be a brief rally. Investors have enjoyed double-digit returns across most global stock markets. However, France's CAC 40 index is in the negative, down 1.5 per cent, and on track for its worst year in over a decade. The French index has lost out to other European markets too. The decision to hold a general election in June by President Emmanuel Macron is largely to blame. Months of political infighting ensued when Macron's gamble failed. That move deprived the nation of the steady leadership it desperately needed to rein in a budget imbalance that ranks among the worst in Europe. French credit rating agencies have issued a dire warning that the country's finances are spiralling out of control. They cited the government's disintegration after a vote of no confidence and borrowing prices surpassing those of Greece. Claudia Panseri, chief investment officer for France at UBS Wealth Management, said, "The situation could degenerate if the deficit or even projections of the deficit show a deterioration." Panseri added, "I think that insurers and banks will continue to underperform." Still, French stocks had their best week since February. Some investors are betting that the worst of the news has already been priced in. But several other investors think the relief rally won't last and the CAC 40's potential gains in 2025 will be capped. None

Popular Tags:

Share This Post:

Money-Wise: Planning to become a SIP expert? Here are some golden rules to reap profits

December 20, 2024

US economy expanded faster in third quarter than originally estimated: Data

December 19, 2024What’s New

Fed's rate cut sparks inflation concerns, market selloff

- By Sarkai Info

- December 19, 2024

Spotlight

China's regulators vow to stabilise property, stock markets

- by Sarkai Info

- December 16, 2024

Ghana's president-elect says IMF deal to cap radical reforms

- by Sarkai Info

- December 16, 2024

Today’s Hot

-

- December 15, 2024

-

- December 15, 2024

-

- December 15, 2024

Fed to cut rates once more before slowing the pace in 2025

- By Sarkai Info

- December 14, 2024

Broadcom sees massive opportunity over the next three years

- By Sarkai Info

- December 14, 2024

China struggles with deflation and looming trade battle

- By Sarkai Info

- December 14, 2024

Featured News

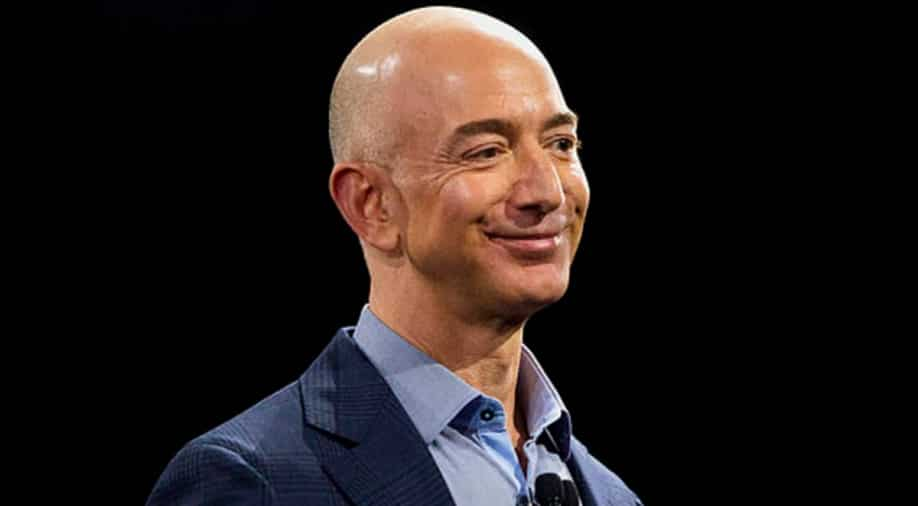

Bezos prepares for new administration amid Kuiper delays

- By Sarkai Info

- December 14, 2024

Latest From This Week

Russia faces delays in trade settlements caused by US pressure

BUSINESS-ECONOMY

- by Sarkai Info

- December 13, 2024

China steps up stimulus to recharge growth ahead of US tariffs

BUSINESS-ECONOMY

- by Sarkai Info

- December 13, 2024

From TikTok to Nvidia, The US-China tech war is getting uglier

BUSINESS-ECONOMY

- by Sarkai Info

- December 13, 2024

Subscribe To Our Newsletter

No spam, notifications only about new products, updates.

Popular News

Top Picks

US weighing new, harsher sanctions on Russia's lucrative oil trade

- December 12, 2024

China gets a head start on a looming trade war with the US

- December 12, 2024

World Bank predicts Myanmar's economy to contract this year

- December 12, 2024