So far in 2024, investors have poured a record $1 trillion into the US exchange-traded funds, marking yet another milestone for the sector. That is largely thanks to the euphoria sweeping Wall Street, particularly driven by AI. Net inflows for the year have already topped the record set in 2021 of $903 billion. There are still 16 trading days remaining in the year for that figure to jump more. An easy-to-trade exchange-traded fund (ETF) wrapper has piqued investors' interest in assets ranging from conservative fixed income to risky leveraged bets, including Bitcoin, which has contributed to the boom. As a result of investors' optimism about the new government and Trump's stance on taxes, the market saw unprecedented levels of volatility in November, sending stock prices soaring to new all-time highs. ETFs of all kinds witnessed record inflows of $155 billion, with an average of almost $7.3 billion per day. The S&P 500 had its best month of the year in November. Last week, the index marked its 46th record for the year. According to Eric Balchunas, a senior ETF analyst at Bloomberg Intelligence, given November's lower-than-average 21 trading days, that historic monthly haul is "shocking." He attributes the exuberance to a "Trump bump." Bloomberg's Balchunas said, "It is going to be difficult to top this year. He added, "ETFs are going to take in flows, but the strength of the market tailwinds will vary. Right now, they are strong." None

Popular Tags:

Share This Post:

Money-Wise: Planning to become a SIP expert? Here are some golden rules to reap profits

December 20, 2024

US economy expanded faster in third quarter than originally estimated: Data

December 19, 2024What’s New

Fed's rate cut sparks inflation concerns, market selloff

- By Sarkai Info

- December 19, 2024

Spotlight

China's regulators vow to stabilise property, stock markets

- by Sarkai Info

- December 16, 2024

Ghana's president-elect says IMF deal to cap radical reforms

- by Sarkai Info

- December 16, 2024

Today’s Hot

-

- December 15, 2024

-

- December 15, 2024

-

- December 15, 2024

Fed to cut rates once more before slowing the pace in 2025

- By Sarkai Info

- December 14, 2024

Broadcom sees massive opportunity over the next three years

- By Sarkai Info

- December 14, 2024

China struggles with deflation and looming trade battle

- By Sarkai Info

- December 14, 2024

Featured News

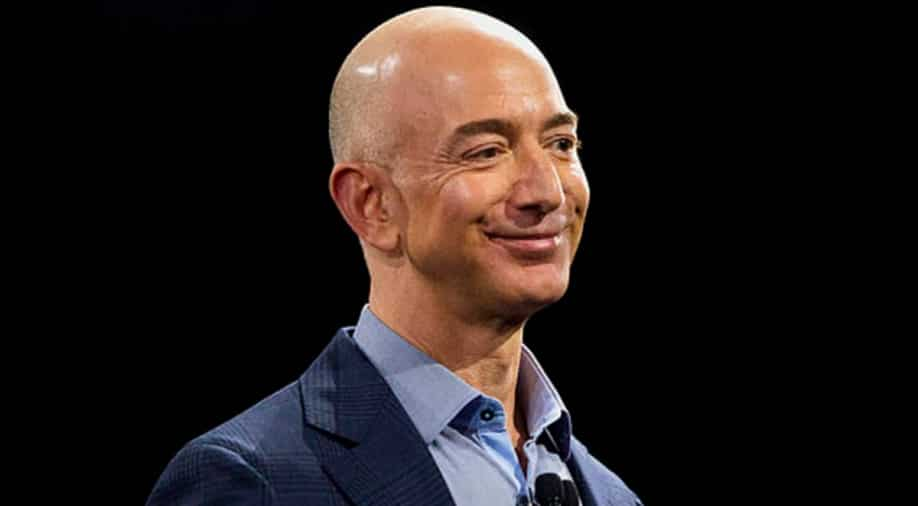

Bezos prepares for new administration amid Kuiper delays

- By Sarkai Info

- December 14, 2024

Latest From This Week

Russia faces delays in trade settlements caused by US pressure

BUSINESS-ECONOMY

- by Sarkai Info

- December 13, 2024

China steps up stimulus to recharge growth ahead of US tariffs

BUSINESS-ECONOMY

- by Sarkai Info

- December 13, 2024

From TikTok to Nvidia, The US-China tech war is getting uglier

BUSINESS-ECONOMY

- by Sarkai Info

- December 13, 2024

Subscribe To Our Newsletter

No spam, notifications only about new products, updates.

Popular News

Top Picks

US weighing new, harsher sanctions on Russia's lucrative oil trade

- December 12, 2024

China gets a head start on a looming trade war with the US

- December 12, 2024

World Bank predicts Myanmar's economy to contract this year

- December 12, 2024