Foreign portfolio investors (FPIs) had already injected Rs 22,363 crore in July, Rs 14,955 crore in June, and Rs 8,760 crore in May. The positive trend follows a net withdrawal of Rs 10,949 crore in April, marking a stark turnaround in foreign investment sentiment towards Indian debt. Foreign Portfolio Investors have infused Rs 11,366 crore into the Indian debt market in August 2024, according to data from depositories. This surge in investment has pushed the total foreign portfolio investor inflows into the debt segment beyond Rs 1.02 lakh crore for the year so far, according to a report by PTI. The robust inflows come after a significant announcement last year that India would be included in JP Morgan's Emerging Market government bond indices. This inclusion, officially happening in June 2024, has driven foreign portfolio investors to ramp up their investments in anticipation and following the integration into global bond indices. Foreign portfolio investors (FPIs) had already injected Rs 22,363 crore in July, Rs 14,955 crore in June, and Rs 8,760 crore in May. The positive trend follows a net withdrawal of Rs 10,949 crore in April, marking a stark turnaround in foreign investment sentiment towards Indian debt. "Since the announcement of India's inclusion in the global bond indices, foreign portfolio investors have been front-loading their investments in the debt market," said Himanshu Srivastava, Associate Director at Morningstar Investment Research India. "The momentum has continued even after the inclusion, showing sustained confidence in India's debt instruments." On the flip side, foreign portfolio investors have been pulling out from Indian equities, with over Rs 16,305 crore withdrawn so far this month. This outflow is attributed to multiple factors, including the unwinding of the yen carry trade, growing recession fears in the U.S., and the impact of geopolitical tensions. "The post-budget increase in capital gains tax on equity investments has also contributed to the sell-off," Srivastava noted. High valuations of Indian stocks and global economic uncertainties, such as weak jobs data from the U.S. and concerns over interest rate cuts, have made foreign portfolio investors cautious. Manoj Purohit, Partner & Leader, Financial Services Tax at BDO India, commented, "Despite global slowdown and geopolitical crises, India remains an attractive long-term investment destination, especially in the debt market." In sectoral trends, foreign portfolio investors have been significant sellers in financials, driven by concerns over slow deposit growth and challenges in banks' Q1 FY25 performance, including shrinking margins and rising provisions. Conversely, they have shown interest in telecom and healthcare, sectors viewed as safer with promising growth prospects. None

Popular Tags:

Share This Post:

Money-Wise: Planning to become a SIP expert? Here are some golden rules to reap profits

December 20, 2024

US economy expanded faster in third quarter than originally estimated: Data

December 19, 2024What’s New

Fed's rate cut sparks inflation concerns, market selloff

- By Sarkai Info

- December 19, 2024

Spotlight

China's regulators vow to stabilise property, stock markets

- by Sarkai Info

- December 16, 2024

Ghana's president-elect says IMF deal to cap radical reforms

- by Sarkai Info

- December 16, 2024

Today’s Hot

-

- December 15, 2024

-

- December 15, 2024

-

- December 15, 2024

Fed to cut rates once more before slowing the pace in 2025

- By Sarkai Info

- December 14, 2024

Broadcom sees massive opportunity over the next three years

- By Sarkai Info

- December 14, 2024

China struggles with deflation and looming trade battle

- By Sarkai Info

- December 14, 2024

Featured News

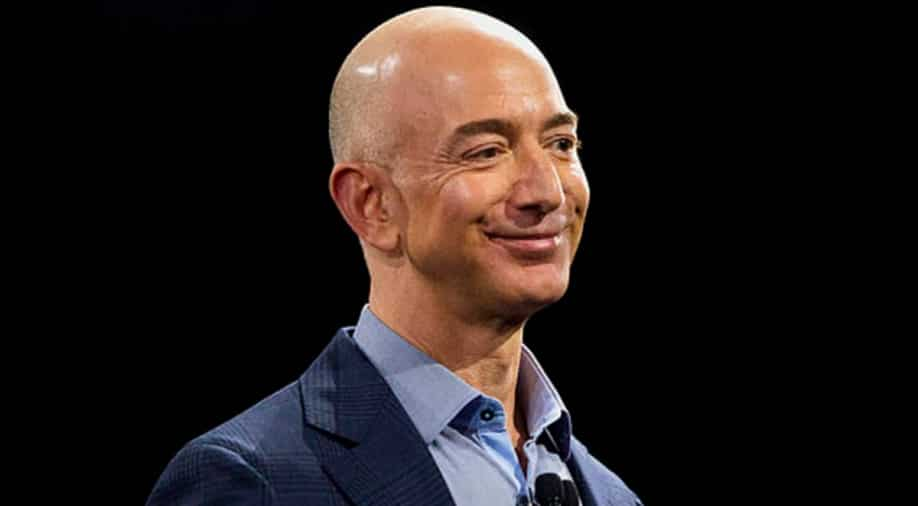

Bezos prepares for new administration amid Kuiper delays

- By Sarkai Info

- December 14, 2024

Latest From This Week

Russia faces delays in trade settlements caused by US pressure

BUSINESS-ECONOMY

- by Sarkai Info

- December 13, 2024

China steps up stimulus to recharge growth ahead of US tariffs

BUSINESS-ECONOMY

- by Sarkai Info

- December 13, 2024

From TikTok to Nvidia, The US-China tech war is getting uglier

BUSINESS-ECONOMY

- by Sarkai Info

- December 13, 2024

Subscribe To Our Newsletter

No spam, notifications only about new products, updates.

Popular News

Top Picks

US weighing new, harsher sanctions on Russia's lucrative oil trade

- December 12, 2024

China gets a head start on a looming trade war with the US

- December 12, 2024

World Bank predicts Myanmar's economy to contract this year

- December 12, 2024